Robust, reliable and independent insight that stands up to scrutiny

Independent social and market research agency helping organisations make better-informed decisions since 1965

Because no two projects are the same, our experienced team provide tailor-made research solutions, adapting our approach to help you achieve your objectives and reach your target audience.

A successful partnership

As research partners, we’ll become an extension of your team. Our flexible and collaborative approach, with strong communication, means you’re always kept in the loop and can trust us to deliver.

Benefit from research and sector expertise

With the combination of research expertise and deep sector knowledge you’ll receive richer insight and can rest assured that we speak your language and we know what works.

More than just a safe pair of hands

What you need most is a team you can trust. With more than 55 years’ experience, we’ve developed processes to ensure you receive high quality insight, on time and on budget. We’re also agile – able to adapt and scale to meet your needs.

Find out more about who we are and what we do

We specialise in providing insight across a range of sectors

-

![]()

Financial Services

We provide insight to help financial service providers better support their customers.Learn more -

![]()

Work & Welfare

We can help policy makers collect robust evidence to guide effective decision-making around work and welfare.Learn more -

![]()

Housing

We help housing providers, government and businesses within the housing sector to better understand their customers and make better decisions.Learn more -

![]()

Health & Wellbeing

We help policy makers devise and evaluate strategies to mitigate long term impacts on physical and mental health. We also support the healthcare system to develop and embed effective initiatives.Learn more -

![]()

Energy & Environment

Our sector specialists help government, businesses and third sector organisations gain the insight needed to make better-informed decisions on energy usage and environmental policies.Learn more -

![]()

Higher Education

We help higher education providers and policy makers navigate challenges, providing crucial insight to better support students before, during and after their higher education experience.Learn more -

![]()

Education, Learning & Skills

Ensuring that the UK has a population with the right skills, competencies and qualifications is vital to help us compete, succeed and prosper in the modern global marketplace.Learn more -

![]()

Regulation

We help regulatory bodies collect high-quality independent data to make fair and informed decisions to support businesses, protect consumers, and lay the foundations for economic growth.Learn more -

![]()

Business & Enterprise

The business environment is fast-moving, with customer needs and expectations growing. To succeed and stay ahead of the curve, businesses make frequent decisions that will determine future success.Learn more

-

“IFF have proven to be an extremely consistent, reliable and trustworthy data supplier. They have never failed to hit delivery milestones, always achieve targets, and continue to improve the quality of the research conducted on our behalf. Innovation seems deep rooted in how IFF operates…further evidence that IFF really are willing to go above and beyond for their customers.”

Daniel Robinson,

Surveys and Economic Indicators – ASGS, ONS

-

“It has been a pleasure working with the IFF Research team on the Primary Care Gambling Service Evaluation. IFF Research have excellent experience and were able to fulfil the brief they were given in a timely manner. In particular, we appreciated their sensitive and thoughtful approach to working with various stakeholders on this evaluation piece. A big thank you to all the team who worked on this.”

Alice Gaskell,

Evaluation Lead, GambleAware

-

“Professional, friendly and approachable service with a detailed understanding of our research needs and a willingness to meet our specific reporting requirements. Would thoroughly recommend and use again.”

Farai Syposz,

Principal Research Officer, ACAS

IFF Research is always on the lookout for talented people to join our team

We welcome and encourage people who think outside of the norm. Creative problem solvers who are inspired to help others find solutions, and who are not afraid to be themselves. Our people are bright, fun and friendly, which is what makes our work environment interesting, inclusive and engaging.

-

Flexible work environment – we create a happy and healthy workplace by enabling people to work in a way which suits them.

-

Supportive culture – we’re proud and protective of our friendly and supportive culture, designed to help our team thrive.

-

Continuous learning – we put a great emphasis on personal and professional development, including giving and receiving feedback.

Have a read of our latest news and blogs

-

![]()

Tenant Satisfaction and preparing to publish

In 2023, the Social Housing regulator implemented new tenant satisfaction measures (TSMs) for social housing providers to ask their tenants, as part of understanding the customer experience of using the services they provide.Learn more -

![]()

A day in the life of Nicola, an Associate Director here at IFF

Curious about a day in the life of a researcher at IFF? We caught up with Nicola, one of our Associate Directors, to give you a sneak peek into her daily routine.Learn more -

![]()

Residential Rehabilitation: Supporting Public Health Scotland with their National Mission

We evaluated two aspects of residential rehabilitation, shedding light on important insights that can shape future policies and support systems.Learn more -

![]()

Improving holistic family support for children, young people and their families in Scotland

The Scottish Government commissioned IFF Research to conduct an evaluation of the Whole Family Wellbeing Funding (WFWF) to understand what the first year of the funding is being used for and how family support is being delivered.Learn more -

![]()

The Impact of Respite Rooms for Victims of Domestic Abuse and Violence Against Women and Girls

There is strong evidence showing Violence against Women and Girls (VAWG) and homelessness are linked. The availability of safe accommodation plays an important role in avoiding further incidents.Learn more -

![]()

Inside IFF: with Director, Sarah

Ever wondered what working at IFF is like? We recently chatted with Sarah, who works on delivering research and insight for clients concerned with work, welfare, housing, community and wellbeing.Learn more -

![]()

Latest Employer Skills Survey published

Our knowledge of and expertise using ESS data is a shining example of the insight we can provide to universities about the labour market to help inform decisions around course development and careers services.Learn more -

![]()

Prioritising Student Mental Health: The journey continues

Looking after young people’s mental health is high up on The Governments priorities. With most mental health conditions making an appearance before the age of 24 (1), time spent in Higher Education is critical for offering support to young people.Learn more -

![Image of people smiling, hand holding]()

Community Vaccine Champions demonstrate an important proof of concept

The Department for Levelling Up, Housing and Communities (DLUHC) commissioned us to evaluate the Community Vaccine Champions programme. We found that both flexibility and locally embedded Champions were the key to the programmes success.Learn more -

![]()

Change in the air?

At Manchester’s Housing conference back in June, many of the conversations both on stage and around the fringes sensed the possibility of change in the air, and what that may mean for the housing sector.Learn more -

![]()

Social Housing: Working together to drive meaningful change

This week we saw Prince William launch Homewards, a five-year programme that will bring local organisations together to end street homelessness.Learn more -

![]()

Building Knowledge of Women’s Lived Experience of Gambling and Gambling Harms across Great Britain – Research Findings

Voices of women with lived experiences of gambling and gambling harms have always been important, but always underrepresented and underexplored in popular discourse around gambling harms and support treatments.Learn more -

![]()

Recently published DfE study highlights concerns around teacher and leader pay and workloads

The findings of a report recently published by the Department of Education reveal that teachers and leaders are working excessive workloads and are dissatisfied with their payLearn more -

![]()

Sexual misconduct in HE: building a national picture

The disproportionate incidence of sexual misconduct in Higher Education (HE) is a troubling yet well-documented reality. Despite this, a sector-level measure of prevalence remains underdeveloped, something the OfS is working hard to address.Learn more -

![]()

Green Social Prescribing: what do patients, the public and clinicians think?

Our project ‘Preventing and tackling mental ill health through green social prescribing’ gathered robust evidence on perceptions and behaviours related to green social prescribing.Learn more -

![]()

Social Housing: Jeremy Hunt may not be our Ryan Reynolds, but we’ll certainly be cheering the sector on

After a tough year of turmoil and underinvestment, with one heart-breaking headline after another, we look towards another difficult year for the social housing sector.Learn more -

![]()

The tenant satisfaction measures: our lessons learned so far

As the social housing sector braces itself for the final month of the financial year, and implementing the new tenant satisfaction measures (TSMs) feels more real than ever before, we wanted to share some of what we’ve learned.Learn more -

![]()

A step in a new direction – discovering a career in social research

From equine grad to senior research executive, Amy shares her experience of her early career in social research, including the support she’s received along the way.Learn more -

![]()

Flex is best: A human-first approach to flexible working

As a recruiter, I’ve seen many changes in the way people work. Not that long ago, it was the norm for people to work above and beyond hours without compensation. Many of us have travelled across the country for hour-long face to face meetings.Learn more -

![]()

Looking beyond the requirements of the TSMs

The TSMs will come into effect in just under 2 months. Ahead of that, we reflect on how these measures should be seen as more than just a regulatory requirement. And rather an opportunity to make sure you’re doing what matters most to your customers.Learn more -

![]()

Community volunteering at IFF

At Christmas, instead of sending unnecessary gifts to our clients, we give on their behalf instead. This year, we chose to support Refettorio Felix.Learn more -

![]()

Evaluation of the The Primary Care Gambling Service published

The Primary Care Gambling Service (PCGS) is a primary care-based pilot service located in South East London for adults aged 18 or over experiencing harm from gambling. Findings from our evaluation of the PCGS service have been published.Learn more -

![]()

The impact of overdrafts on switching current accounts – report launch

Our research in partnership with CASS, operated by Pay.UK, found that millions of overdraft users are currently sticking with their current account providers, due to misconceptions around switching current account when using an overdraft.Learn more -

![]()

Key takeaways from the Tenant and Resident Engagement conference

Attending Inside Housing’s Tenant and Resident Engagement Conference last week was an opportunity to discuss the importance of putting tenants at the heart of social housing, and we heard our own advice echoed by many speakers.Learn more -

![]()

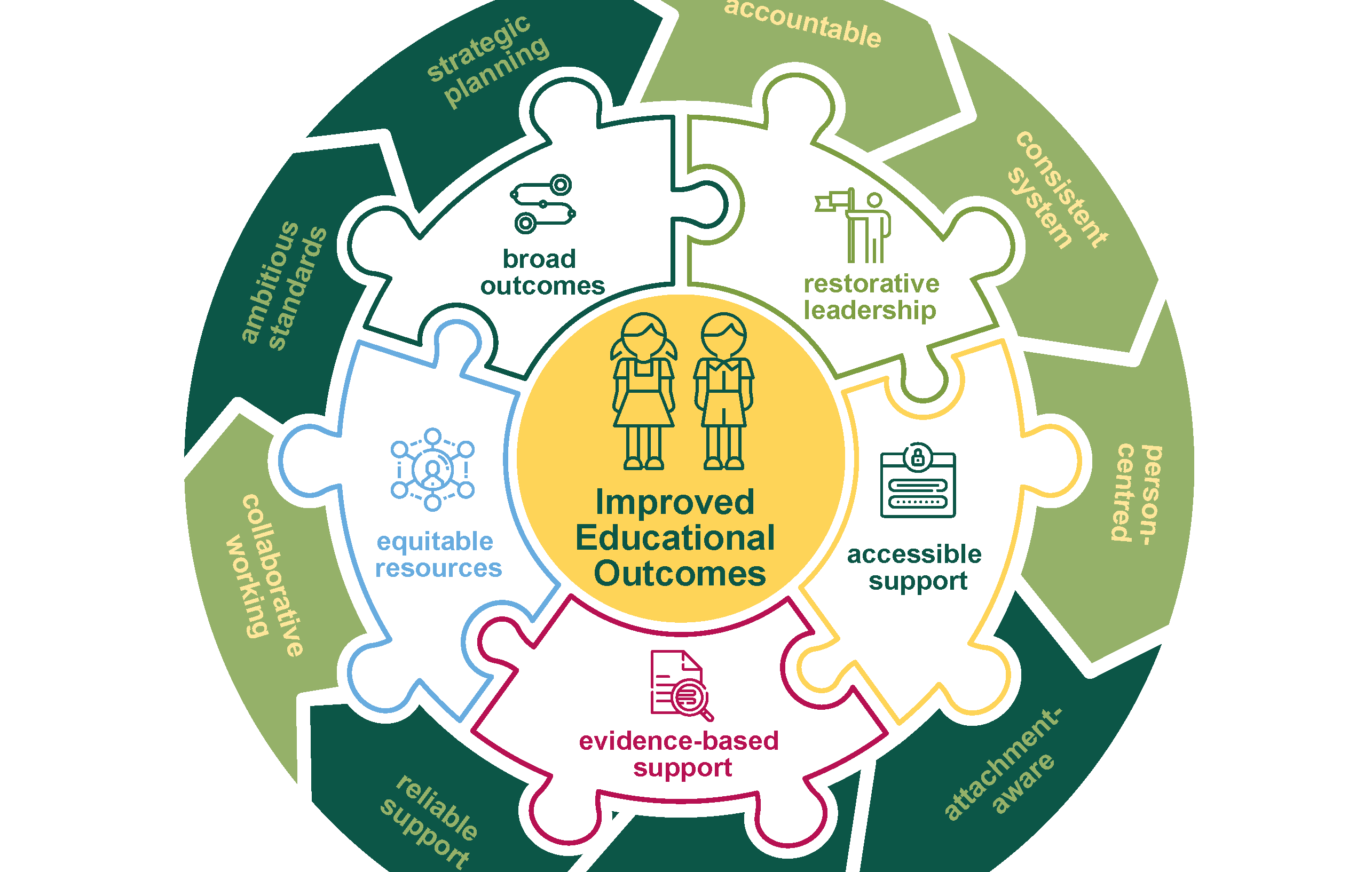

Improving educational outcomes for looked after children: Welsh Government publishes our findings

Our study aimed to assist the Welsh Government in shaping future policy for supporting looked after children in education, to improve educational outcomes.Learn more -

![]()

Key takeaways from the Tenant and Resident Engagement conference

Attending Inside Housing’s Tenant and Resident Engagement Conference last week was an opportunity to discuss the importance of putting tenants at the heart of social housing, and we heard our own advice echoed by many speakers.Learn more -

![]()

Exploring Women’s Lived Experience of Gambling and Gambling Harms

Women’s lived experiences of gambling and gambling harms remains an important and topical social issue, but existing literature on this has historically been more male dominant.Learn more -

![]()

Supporting continued growth

It’s been a big year for IFF. We’ve grown our research team by 15% in just six months, celebrated record turnover, been named 4th fastest growing independent agency by MRS and we’ve been shortlisted for Agency of the Year and Best Place to Work.Learn more -

![]()

The tenant satisfaction measures final requirements – our reflections

Following the publication of the revised tenant satisfaction measures (TSMs) by the Regulator of Social Housing, we know most housing providers will be busy trying to understand the changes and what they need to do next.Learn more -

![]()

Research Intern, Janay Hastings, gives the lowdown on life at IFF

It’s National Intern Week (26th-30th September) and what better way to learn about life as a Research Intern at IFF than getting the lowdown from a current intern. We sat down with Janay to see how things are going…Learn more -

![]()

The cost of living crisis – are you hitting the mark?

Seven years ago, I submitted a lengthy dissertation describing how the ongoing changes to housing policy have affected the ability for social housing providers to meet the needs of social housing tenants.Learn more -

![]()

Integration Area Programme Evaluation – Our findings published

Findings from our evaluation for three strands of the Integration Area Programme (IAP), an initiative from the Department for Levelling Up, Housing and Communities (DLUHC) have been published.Learn more -

![]()

A who’s who of Boris’ Universities Ministers

Following a whirlwind few weeks in Westminster, when Ministers have been in and back out of the door quicker than you can say “Hasta la vista, baby,” we thought we’d mark the end of the Boris administration.Learn more -

![]()

Coastal Communities Fund: IFF proves positive impact of community projects along the English coast

An evaluation of the Coastal Communities Fund’s work found a positive impact on English coastal communities, generating jobs and new amenities for residents and tourists. The fund was set up to finance community projects taking place along the coast.Learn more -

![]()

Our net zero pledge – the story so far

Some of you may recall that IFF signed up to the Market Research Society’s Net Zero Pledge back in November 2021, committing ourselves to net zero emissions by 2026. What have we been up to since then, I hear you ask? Quite a lot actually!Learn more -

![]()

Apprenticeship Evaluation 2021 results published

Satisfaction with apprenticeships remains high, found a recently published DfE study. Conducted by IFF Research, the Apprenticeship Evaluation 2021 explores the views of experiences of learners and employers involved in apprenticeships.Learn more -

![]()

From Telephone Interviewer to Marketing Assistant: My journey at IFF

Three years of university, got the degree, did the graduation ceremony. Question is, what’s next?Learn more -

![]()

How can we support social housing customers through the cost-of-living crisis?

With the cost-of-living crisis on everyone’s mind at the moment, it’s little surprise that it was the focus of Housing Quality Network’s (HQN) recent annual conference, which discussed how we got to where we are now.Learn more -

![]()

Scottish Employers’ Perspectives of the labour market in 2021: Scottish Government publishes our research

Research conducted by IFF Research on behalf of Scottish Government has today been published as Official Statistics. The research found that just over half of employers had a full or part-time vacancy over the past 12 months.Learn more -

![]()

Climate Change in Education: time to get to work

Last month the Department for Education (DfE) published its Sustainability and Climate Change policy paper outlining a vision that the UK education system becomes the “world-leading education sector in sustainability and climate change by 2030”.Learn more -

![]()

Social housing stigma: The uncomfortable truth

It’s clear that the media and the government’s drive towards home ownership exacerbates stereotypes. However, the ways in which the social housing sector also perpetuates social housing stigma requires a deeper dive.Learn more -

![]()

DfE’s higher education policy reform – a quick temperature check

The DfE’s higher education policy reform consultation closed on May 6th, and whilst the sector eagerly awaits its outcomes, we thought we’d provide a quick temperature check on the responses given by mission groups and sector bodies so far.Learn more -

![]()

Don’t forget to look under the bonnet

One of the things that has been borne out of the Grenfell tragedy was the Social Housing White Paper, and most recently, the proposed Tenant Satisfaction Measures (TSMs) from the Regulator of Social Housing. Kate explores the proposed TSMs.Learn more -

![]()

Bucking the trend: Futures evidence how staff engagement is key to improving customer satisfaction

Engaging your staff in customer feedback is pivotal to creating long lasting, effective change. Acutely aware of this, Futures Housing Group adapted their customer feedback in March 21 to engage staff without creating a condescending tone.Learn more -

![]()

Social housing: The impact of external trends on customer satisfaction

Understanding and interpreting what your customer satisfaction scores are saying can be challenging at the best of times in social housing.Learn more -

![]()

Using Graduate Index to better prepare graduates for the working world

Graduate Index is a tool which measures graduate success across seven different social and personal measures to give a broader picture of what graduates go on to achieve.Learn more -

![]()

Discussing best practice in resident engagement

Customer engagement can mean different things to different people within social housing. To understand how to effectively deliver meaningful customer engagement within housing, providers should start by evaluating this from a strategic level.Learn more -

![]()

Beginning our journey to net zero

Our team attended a sustainability summit delivered by SUSTx to help UK organisations on the road to net zero. Topics such as energy, transportation, procurement and circularity were discussed, with a focus on supporting change.Learn more -

![]()

Bringing housing providers together to discuss the TSMs

We hosted a shared practice web session, bringing together 27 housing practitioners, representing more than 20 different housing providers from across the UK, to discuss the Regulator of Social Housing’s proposed TSMs.Learn more -

![]()

Discussing the implications of the proposed tenant satisfaction measures

Following the launch of the consultation for the proposed TSMs by the Regulator of Social Housing just before Christmas, housing providers have been discussing and reviewing the proposal to get a clear sense of what the Regulator is suggesting.Learn more -

![]()

Building knowledge of women’s lived experience of gambling and gambling harms across Great Britain

From receiving scratch-cards as birthday gifts, to social betting at races and casinos, gambling, is seen by many in our society as part of everyday life. Some people, however, experience negative consequences from gambling.Learn more -

![]()

Comparing LEO data with Graduate Index

The Longitudinal Educational Outcomes (LEO) is an important dataset within higher education. But, the concern with viewing it in isolation is that it is only one indicator of graduate success.Learn more -

![]()

Tenant satisfaction measures: our reflections on the proposed new measures

The Regulator of Social Housing in England launched their proposed tenant satisfaction measures (TSMs) for consultation on 9th December. These measures are in light of the proposals set out in the Social Housing White Paper launched in November 2020.Learn more -

![]()

Where there’s #iwill, there’s a way: Early learnings from IFF’s Evaluation of the Co-op Foundation #iwill Fund

#iwill is a national campaign to promote social action among young people, set up by the Department for Digital, Culture, Media and Sport (DCMS) and the National Lottery Community Fund.Learn more -

![]()

“Putting customers at the heart” in Financial Services

Putting customers at the heart is a phrase that is used across so many organisations these days, but what does it really mean?Learn more -

![]()

Schools’ views on multi-academy trusts: DfE research published

We found that the vast majority of schools in a multi-academy trust (MAT) felt the overall impact on the school on joining or forming one had been positive.Learn more -

![]()

Reflections from the MRS Sustainability Summit: Getting our house in order

One of the key messages that came out of the recent MRS Sustainability Summit, was about us as research agencies getting our own houses in order.Learn more -

![]()

How can market research reduce commercial risk?

We have all faced difficult decisions in our professional lives. Should we launch a new product or service? Is now a good time to go ahead with that marketing strategy or PR campaign?Learn more -

![]()

IFF Research signs the MRS Net Zero Pledge, committing to net zero by 2026

We’re delighted to announce that IFF have signed this important Pledge. This trigger builds on environmental improvements we at IFF have started to implement over the last few years, but crucially it provides a target.Learn more -

![]()

DfE research helps support schools and pupils and begin educational recovery

The Covid-19 pandemic has greatly affected all aspects of society, and education has been no exception.Learn more -

![]()

IFF launches new Energy & Environment sector

We believe that with a collective effort there is a future to fight for, and that this climate crisis can be abated.Learn more -

![]()

Report calls for CEOs to see youth employment as key part of recovery

A new report commissioned by Movement to Work (MtW) and Youth Futures Foundation (YFF), and co-sponsored by Accenture and Sage— reveals the economic and social benefits that can be achieved when UK employers support youth employment programs.Learn more -

![]()

Improving educational outcomes for looked after children: Welsh Government publishes our findings

The Welsh Government has published our research findings exploring an integrated approach to improving educational outcomes for looked after children.Learn more -

![]()

New commission by DWP to evaluate Kickstart Scheme

IFF Research and Professor Sue Maguire from the Institute for Policy Research have been commissioned to evaluate the Department for Work and Pensions’ (DWP) Kickstart Scheme.Learn more -

![]()

Latest research report for the Scottish Government’s Fair Start Programme

We are delighted to announce publication of our research findings from the third wave of a longitudinal study for the Scottish Government, evaluating their Fair Start Scotland (FSS) programme.Learn more -

![]()

Our inaugural Graduate Index report is published

The Graduate Index is a survey that measures graduates’ successes across seven social and personal measures.Learn more -

![]()

Listening and learning from customer feedback – best practice roundtable summary

The Regulator of Social Housing has already expressed that customer satisfaction should not be a box ticking exercise. Part of the feedback cycle is demonstrating the actions and interventions you are taking.Learn more -

![]()

HM Treasury (HMT) has published evaluation results from the PrizeSaver pilot scheme

Over 1 in 10 account holders listed PrizeSaver as their only savings account, suggesting the scheme encouraged some first-time savers, and over 4 in 10 said they were now saving more regularly since opening a PrizeSaver account.Learn more -

![]()

What is two-way customer journey mapping?

This article will discuss what two-way customer journey mapping is, how it differs from traditional customer journeys, and how you can use this technique yourself.Learn more -

![]()

The 5 benefits of customer journey mapping your complaints service

At first glance, mapping your customer’s complaints journey may not seem like a priority for social housing providers. It is an important part of the process to ensure that you are providing the best service possible to your customers.Learn more -

![]()

Providing insight into claimants’ experiences of ESA and PIP

We are delighted that the Department for Work and Pensions has published our report into claimants’ experiences of completing the Employment Support Allowance (ESA) and Personal Independence Payment (PIP) questionnaires.Learn more -

![]()

Innovation and knowledge development in occupational health

We are delighted that the Department for Work and Pensions and the Department of Health and Social Care have published our report on innovation and knowledge development among occupational health providers.Learn more -

![]()

Flexible Operating Hours Evaluation results published

We worked in partnership with Frontier Economics to tackle this question and more, in the evaluation of the Flexible Operating Hours (FOH) pilots.Learn more -

![]()

Finding the best way to communicate with your customers

Zoom calls whilst carrying out repairs, call centre staff working remotely, and closed neighbourhood offices… Continuing to provide efficient and professional customer communication has certainly had its stumbling blocks over the last 18 months.Learn more -

![]()

When life presents unexpected choices

Sometimes things don’t go to plan. Sometimes we simply don’t know what we want. This is true of most things in life from choosing an ice cream flavour to buying a house.Learn more -

![]()

Trust and transparency are the new key drivers of satisfaction

Asking a simple follow-up question helps you understand whether your operatives/contractors are communicating next steps, how residents feel about the communication they’ve received, and the steps you can take to improve that communication.Learn more -

![]()

The Equality and Human Rights Commission publishes results of restraint in schools inquiry

The Equality and Human Rights Commission (EHRC) has published the results of their inquiry into the use of restraint in schools in England and Wales.Learn more -

![]()

It’s not just about getting a well-paid job

I asked my colleagues to spend a couple of minutes thinking about why they went to university and what they wanted to get out of the experience.Learn more -

![]()

Looking through a different lens

Looking back over the last five years or so, we’ve witnessed a fair few major and often unexpected events. To name but a few…Leicester City were crowned Premier League champions, Britain voted to leave the EU, and Trump became US President.Learn more -

![]()

Our report on employer skills needs in Scotland is published

The Scottish Government has recently published the results of the Scottish Employer Skills Survey (ESS) 2020. This flagship survey follows on from the longstanding UK-wide Employer Skills Survey, conducted biennially from 2011 and 2017.Learn more -

![]()

Post-Qualification Admissions: What do students think?

We turn our attention to the most important question in the post-qualifications admissions system debate: do students actually want it?Learn more -

![]()

Post Qualification Admissions and the tale of two (and a half) models

Post qualification admissions (PQA) is a simple idea, based on a simple premise: students should only receive offers from universities once they know their A-Level or equivalent results.Learn more -

![]()

Evaluating In-Depth Assessments (IDAs) for the Regulator of Social Housing

The In-Depth Assessment (IDA) process is a regulatory tool used by the Regulator of Social Housing (RSH) to gather assurance that registered providers are meeting the expectations of the regulator’s standards.Learn more -

![]()

The revival of the ‘big four’ in international student mobility

The international student mobility landscape has been vastly impacted by increasing diversity in the market.Learn more -

![]()

Understanding the experiences of unaccompanied asylum-seeking children joining family in England

We were commissioned to fill a knowledge gap the Department for Education (DfE) identified on the experiences of unaccompanied asylum-seeking children and young people joining family in England.Learn more -

![]()

Reframing the student accommodation compensation debate

Following on from a previous blog on tuition fees, our focus now turns to student accommodation.Learn more -

![]()

Creating a culture of inclusivity in research

The Black Lives Matters movement which came to the fore in 2020 galvanised so many of us to take stock and address the inequalities we observe and enable.Learn more -

![]()

Equality, diversity and inclusion in research: Understanding the current picture

Equality, diversity and inclusion (EDI) is a subject that is very close to our hearts at IFF and top of our corporate agenda, which is why it felt the right choice for the focus of our recent seminar series event.Learn more -

![]()

International Education Strategy: re-visited

When the International Education Strategy launched in 2019 there were two main aims: 1) to increase the value of education exports to £35 billion per year and 2) to increase the number of international students hosted in the UK to 60,000.Learn more -

![]()

Your Social Housing White Paper questions – answered by The Housing Ombudsman

We invited Richard Blakeway, The Housing Ombudsman to address your concerns and respond to your questions about new requirements under the Social Housing White Paper.Learn more -

![]()

Building online student communities: best practice for effective research

During the pandemic, real-time interaction with students has become a growing priority for universities as needs change more rapidly than ever before. Online research communities represent a great way to address this priority.Learn more -

![]()

BEIS launch research into social housing decarbonisation

We’re excited to announce the launch of a study we’re conducting on behalf of BEIS to understand the decarbonisation of social housing.Learn more -

![]()

Compensating the Covid class

There seems a broad consensus now amongst the general public that the massive disruption to students’ learning due to the pandemic should result in some form of compensation of tuition fees.Learn more -

![]()

A housing hero: The Housing Ombudsman is here to help

We invited The Housing Ombudsman, Richard Blakeway, to join us for a conversation and to answer your questions about the impact of proposed changes.Learn more -

![]()

The university challenge: student retention in a Covid world

Some students face a delayed ‘return’ to university while still expected to pay full tuition fees and rents for accommodation. Some report their mental health to be at the lowest it’s ever been, with access to wellbeing services difficult.Learn more -

![]()

Resident engagement is central to social housing regulation

During our recent In Conversation with… event, special guest Jenny Osbourne, Chief Executive of Tpas highlighted key actions that landlords will need to undertake to meet the new regulatory requirements set out in the social housing white paper.Learn more -

![]()

Your Social Housing White Paper questions – answered by The Regulator

Social housing regulation is coming soon – but when? And what are the implications?Learn more -

![Man with a pen in his hand writing]()

The Social Housing White Paper – what’s changing?

The Social Housing White Paper is here, and we have spent the past month coming to grips with what’s new, what’s changing, what’s staying the same, and what’s missing entirely.Learn more -

![]()

Higher education insight guides: recently published

The higher education sector has faced an unprecedented time of upheaval as a result of the pandemic, impacting on all aspects of university life.Learn more