The announcement on Tuesday that the Government’s furloughing scheme will be extended until October will have been welcome news to many employees and UK business owners. Our recent study of 839 UK businesses surveyed between 29 April and 5 May, found that 73% have made use of the scheme demonstrating the reliance of Government support measures. In this article we share the findings from that survey, discussing the implications for UK businesses and their employees, as well as their perception of the government’s response to the coronavirus pandemic.

Use of the Coronavirus Job Retention Scheme

In March, the Government launched the Coronavirus Job Retention Scheme (CJRS), whereby it pays 80% of the salary of employees who are “furloughed” – i.e. whom the employer can no longer offer work – up to a maximum of £2,500 per month.

The scheme has been embraced enthusiastically by UK firms, with our latest survey showing that around three-quarters of businesses (73%) have furloughed, or intend to furlough, at least one member of staff. Furloughing is most prevalent in the Wholesale & Retail (86%), Accommodation & Food (85%), Manufacturing (82%), and Construction (81%) sectors. Conversely, furloughing is less prevalent among Information & Communication businesses (62%), the Professional, Scientific, & Technical sector (51%), and in the Health & Social Work sector (63%).

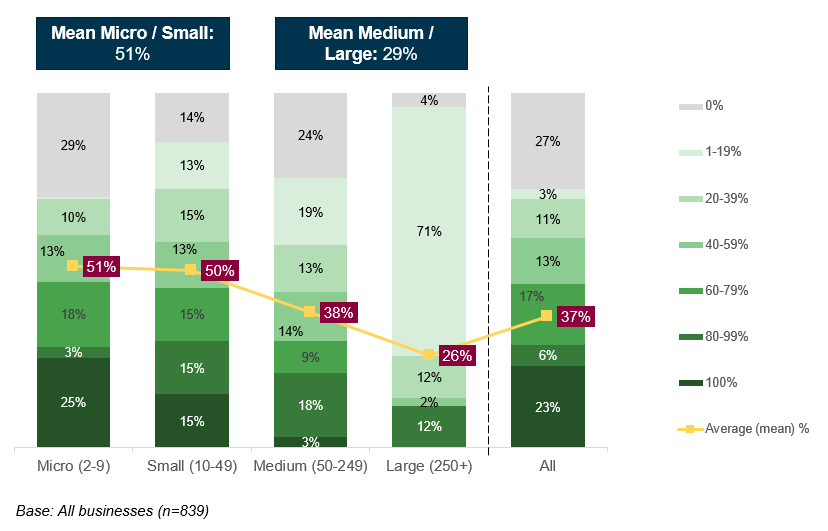

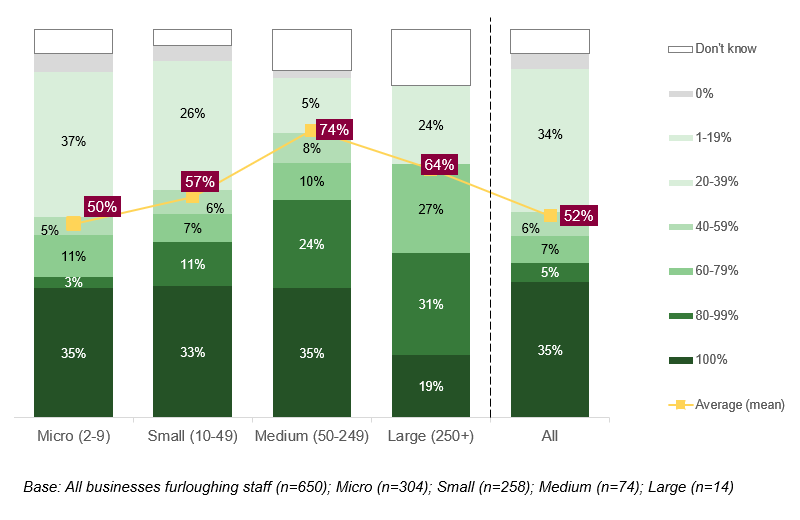

In absolute terms, most businesses are furloughing small numbers of staff – under 10 in most cases. However, the majority are small businesses with small numbers of staff. In percentage terms, smaller firms are furloughing greater proportions of their workforce; an average of 51% among micro and small businesses compared to 29% among medium/large firms (Figure 1.1). Scaling this up to the UK overall, this is likely to amount to around 37% of the workforce.

Figure 1.1 Proportion of staff business have furloughed or intend to furlough

As well as high levels of take up, the CJRS can be seen as a clear success in terms of the impact it has had on the UK business population.

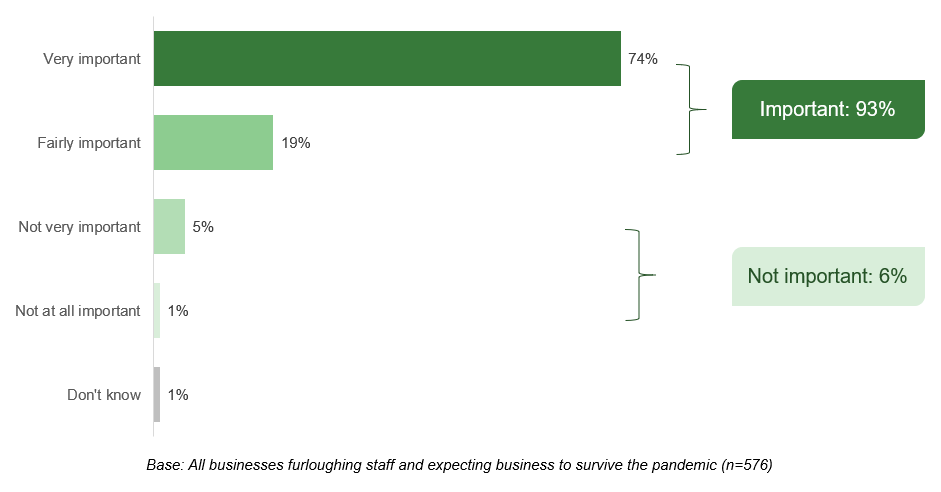

Almost all using the scheme said that it had played an important role in enabling their business to survive the pandemic (93%), with three-quarters saying that it has played a very important role (74%) (Figure 1.2).

There are few areas of the economy that have been untouched by the pandemic, but few have been more effected than the Construction and Accommodation & Food sectors. This is reflected in our findings which show that businesses in these sectors are more likely than other firms to say the CJRS has played a very important role in their survival (89% and 85%).

Post-lockdown recovery

As restrictions begin to lift, thoughts move towards getting back to work, and economic recovery.

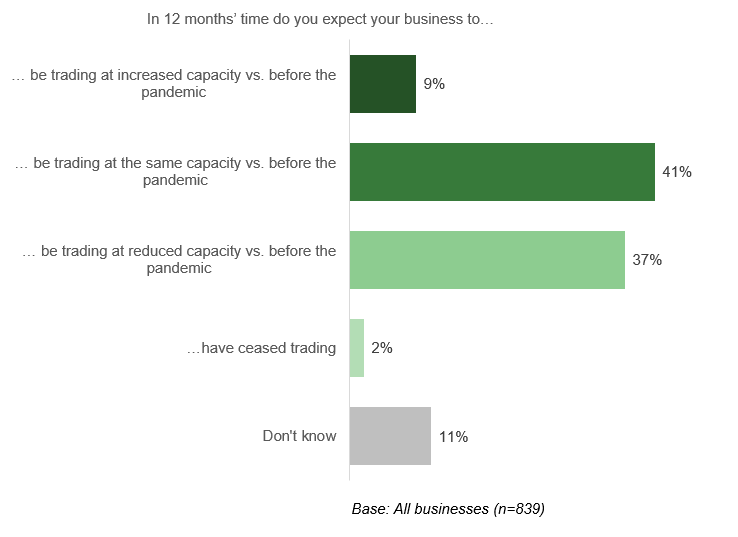

While all businesses have been impacted by the pandemic in some way, there is considerable variation in long-term prospects. For some, coronavirus will be a ‘bump in the road’, but others are expecting a slow recovery. Overall, half expect to be trading at either the same or increased capacity (50%), but a sizeable minority think the business will be operating at a lower capacity (37%) (Figure 1.3). When we look at different sectors, Transport & Storage firms are more negative, with more than half expecting to be operating at reduced capacity (54%), as well as Health & Social Care (55%) and Arts, Entertainment & Recreation (69%).

Accommodation & Food has been one of the hardest hit sectors, and this is reflected in the long-term outlook, with around one in twenty expecting to have ceased trading (4% vs 2% overall).

However, it is clear that any return to previous levels of capacity will be dictated by the way in which social distancing rules are eased, as this will impact different businesses in different ways.

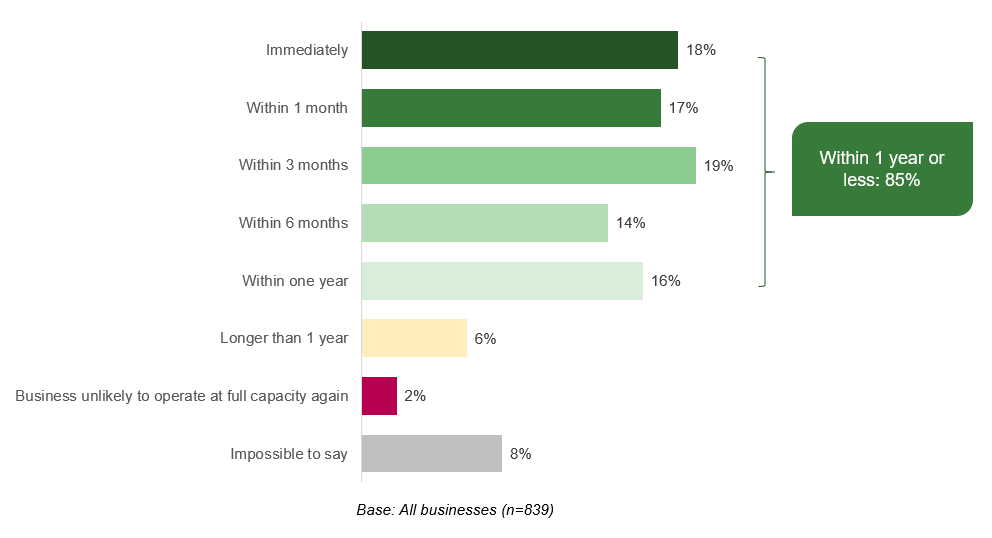

Overall, only around one in five expect to return to full capacity as soon as lockdown measures are eased (18%) (Figure 1.4). For some sectors, however, social distancing restrictions mean that returning to capacity will be much slower; in particular, only 7% of businesses in the Arts, Entertainment, & Recreation sector expect to be fully up and running immediately, and 10% of Wholesale & Retail firms.

Figure 1.4 Length of time to be operating at full capacity after lockdown measures are eased

Our results would appear to demonstrate the rationale for the recent surprise announcement that the CJRS will be extended until October. It indicates that the Government is expecting a slow pace of return to ‘normality’, and that businesses would have been looking at redundancies had the scheme ended in June or July.

We asked businesses who had furloughed employees what proportion they expected to return to work as soon as the scheme ends, had it done so in June. On average, businesses only expected around half to do so immediately (52%), raising the prospect of widespread job losses in the coming months had the scheme come to an end at this point (Figure 1.5).

The extension of the scheme will be welcomed by employees, who will see no change should their employer continue to use the CJRS. However, the announcement that businesses will be expected to contribute more could mean that some will choose not to use the scheme, and that redundancies could still be commonplace during this time.

Figure 1.5 Proportion of furloughed staff expected to return to work immediately, had the CJRS ended in June

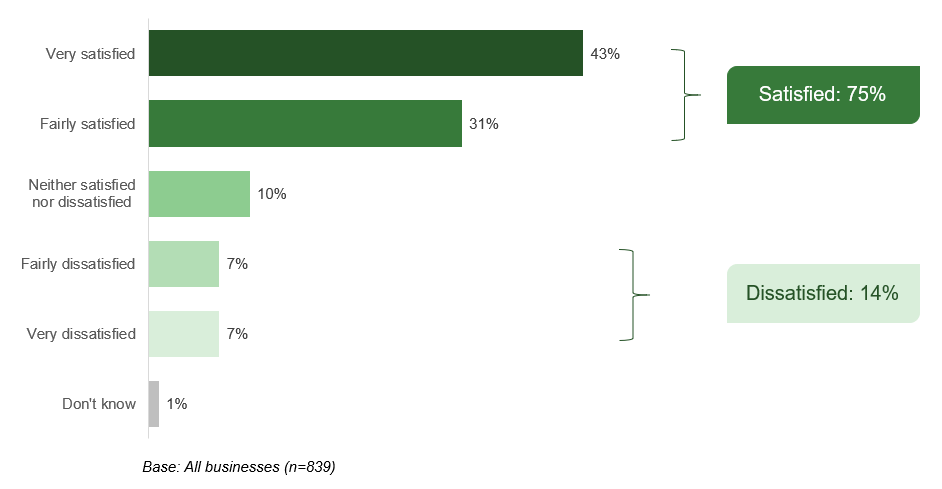

The Government’s response to Covid-19

So far, businesses have remained positive about the support the Government is providing for businesses throughout the Coronavirus pandemic, with three-quarters saying they are satisfied (75% – up from 58% when we surveyed businesses earlier in April) (Figure 1.6). This is consistently the case across businesses of different sizes, but there are some sector differences; Wholesale & Retail firms are more likely to be positive about the Government (85%), while those in the Information & Communication and Health & Social Work sectors are more likely to be dissatisfied (31% in each case vs 14% overall).

Figure 1.6 Satisfaction with the Government’s support to businesses during the Coronavirus outbreak

It will be interesting to see whether this goodwill holds up as details of the Government’s exit strategy from the current level of restrictions become clearer.

Developing and implementing an exit strategy is generally viewed as a balance between restarting the economy and protecting public health. For the former, fewer restrictions as soon as possible would mean that businesses can re-open and the recovery can begin quickly. However, a longer period of severe restrictions would keep the number of Covid-19 cases down and be more beneficial to public health.

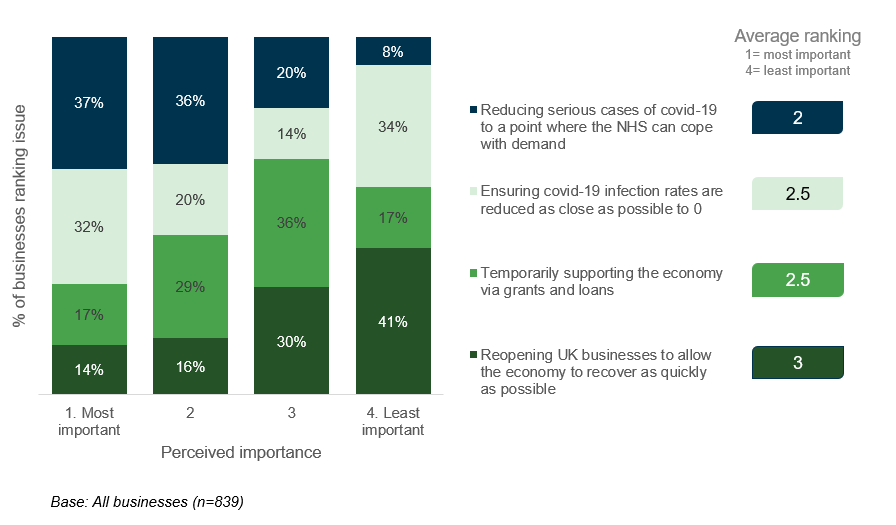

To explore how businesses felt about that balance, we asked them to rank the following in terms of areas the government should prioritise:

- Reopening UK businesses to allow the economy to recover as quickly as possible;

- Temporarily supporting the economy via grants and loans;

- Ensuring covid-19 infection rates are reduced as close as possible to 0; and

- Reducing serious cases of covid-19 to a point where the NHS can cope with demand.

On the face of it, the results are perhaps surprising, with businesses clearly favouring public health over the economy. Only 14% feel that “re-opening UK businesses to allow the economy to recover as quickly as possible” should be prioritised ahead of reducing infection rates and serious cases to protect the NHS. Indeed, businesses were most likely to rank this as least important (41%).

Figure 1.7 Perceived importance of Government priorities

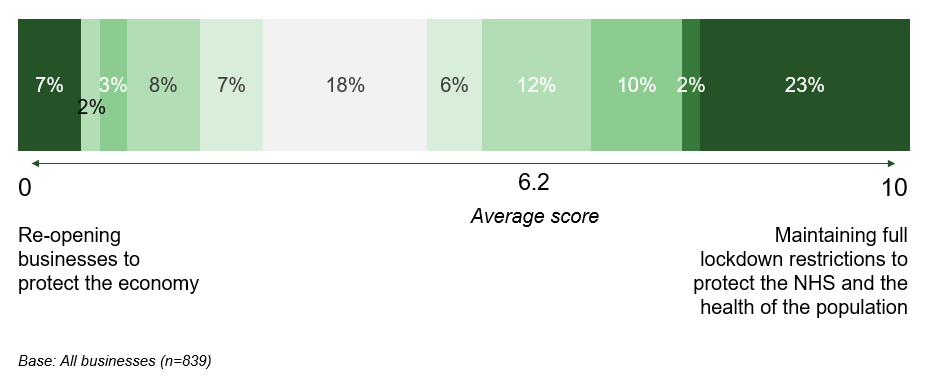

To look at this another way, we also asked businesses to choose, on a scale of 0 to 10, where the Government should focus its efforts – again looking at the balance between re-opening businesses to protect the economy on the one hand, and maintaining restrictions to protect public health at the other end of the spectrum.

Figure 1.8 shows that, at 6.2, the average score was near the middle, but the balance of opinion clearly sits on the side of protecting public health, with around a quarter selecting the most ‘extreme’ end of that scale (23%).

Figure 1.8 Business views on where the Government should focus its efforts

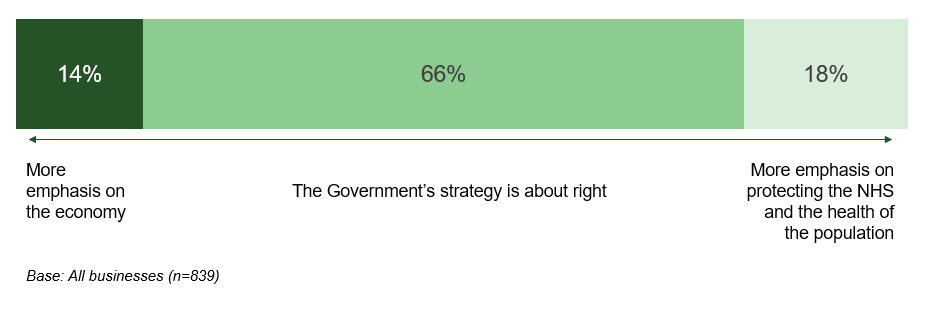

At the moment, the majority of businesses feel that the Government is getting this balance about right (66%), with the remainder divided more or less equally between wanting a greater focus on the economy and on public health (Figure 1.9). This is true across sectors and businesses of different sizes.

Overall, the survey results paint a picture of a fragile business environment. Many businesses appear to be ‘propped up’ by Government support, and they have embraced the schemes made available to them. This has, in turn, boosted the level of satisfaction with the current administration. The extension of the CJRS in particular is significant, and appears to support the business view that the emphasis should be on protecting public health. However, the recent announcement encouraging people to return to the workplace if they cannot work from home would appear to have more of an economy focus, so the Government may struggle to keep businesses on board. As the Government attempts to maintain a balance, it will be interesting to gauge businesses’ reaction to these changes in future waves of the research.

If you’d like to discuss the opportunity of conducting research within your business or sector you can reach Matt on matt.barnes@iffresearch.com